7 February 2008

I'm not a currency trader, but I am a Canadian. I think the present currency trends are pretty clear.

The commodity currencies (such as the Canadian dollar) are down on the recession trade.

The commodity currencies (such as the Canadian dollar) are down on the recession trade.

The (low interest) carry trade currencies (the Swiss Franc and the Japanese Yen) are up, more or less for the same reason (the unwinding of the carry trade).

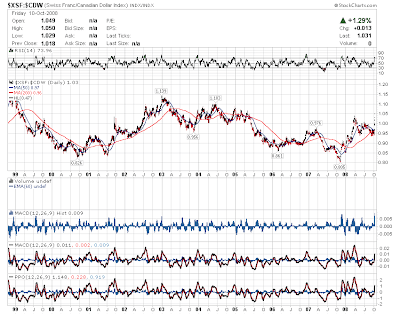

A look at the charts for the Swiss Franc (XSF) and Japanese Yen (XJY) pretty well sums it up. I'm happy to hold my recently appreciated Canadian dollars (though the Toronto Gold Index has been horrible due in part to the currency trend), but if I were Swiss or Japanese now, I wouldn't buy Canadian dollars so long as recession fears are driving the market.

A look at the charts for the Swiss Franc (XSF) and Japanese Yen (XJY) pretty well sums it up. I'm happy to hold my recently appreciated Canadian dollars (though the Toronto Gold Index has been horrible due in part to the currency trend), but if I were Swiss or Japanese now, I wouldn't buy Canadian dollars so long as recession fears are driving the market.

Once the focus returns to inflation (no one has paid attention to inflation since Paul Volcker temporarily resolved the problem in the early 1980s), Canadian dollars and the other resource currencies should have their next leg up, along with the precious metals. But inflation has been raging for years and nobody has paid much attention so far.

Once the focus returns to inflation (no one has paid attention to inflation since Paul Volcker temporarily resolved the problem in the early 1980s), Canadian dollars and the other resource currencies should have their next leg up, along with the precious metals. But inflation has been raging for years and nobody has paid much attention so far.

So how long will it take citizens, politicians, central bankers and investors to notice that inflation is a very big problem?

So how long will it take citizens, politicians, central bankers and investors to notice that inflation is a very big problem?

If we can live surrounded by inflation for as long as we already have without recognizing it for what it is, it strikes me as entirely possible that we will be able to continue ignoring it for some additional time to come. At some point, however, it will no longer be possible to live with inflation day in and day out without discerning that it is not benign. When that time comes, I predict that our thinking will change dramatically....

If we can live surrounded by inflation for as long as we already have without recognizing it for what it is, it strikes me as entirely possible that we will be able to continue ignoring it for some additional time to come. At some point, however, it will no longer be possible to live with inflation day in and day out without discerning that it is not benign. When that time comes, I predict that our thinking will change dramatically....

For those interested in the Swiss Franc specifically, here are links for all my entries concerning the Swiss Franc:

1. Canadians, Buy the Swiss Franc Now!

2. The Swiss Franc Continues To Climb in Canadian Dollars.

3. My first compliment from Fleck.

4. Currencies 101.

5. Another Swiss Franc Buying Opportunity for Canadians.

6. All You Need To Know About Global Money Supply in One Place.

7. The Swiss Franc Is Still Strong.

8. Use "FXF" (CurrencyShares Swiss Franc Trust) To Buy the Swiss Franc

9. Gold is Better Than the Swiss Franc.

10. Swiss Franc Alert.

11. Gold Isn't Gaining All That Much... In Canadian Dollars!

Addendum: Many visitors to this site have enquired about how to purchase the Swiss Franc. The most direct method is simply to purchase Swiss Francs from a currency dealer. In Canada, Custom House Currency Exchange offers competitive rates. You may also wish to contact your broker about an exchange-traded fund or a Swiss Franc government bond (which would pay interest on your investment, but could be subject to decline in value even if the currency itself rises relative to other currencies). Additionally, some banks permit investors to maintain foreign currency accounts. Sophisticated investors may wish to enter this trade through purchasing futures contracts or other types of options, such as calls. Many brokers specialize in foreign currency purchases, so I suggest that you start with a broker familiar to you. As I understand it, Pamela and Mary Anne Aden at Aden Research, for example, will execute foreign currency trades for their customers. But for those who don't know how, simply purchasing the currency from a competitive currency trader (possibly your local bank, or a trader recommended by your bank) will be a good place to get started. Ideally the "spread" between the buy and ask price for the currency should be less than 4 cents on the dollar (roughly 4%). That is, you should not pay a premium of greater than 2% to purchase the currency. This being said, my own experience with currency dealers is that it is very difficult to exchange currencies in this idealized range. Our local broker's rates are much higher, for example. Never exchange currencies in large amounts at airports, hotels and other locations that are charging large premiums to provide a convenience service to travellers. Look for the best rates any time you exchange currencies!

August 5, 2008: As currency purchases at fair exchange rates are extremely difficult to obtain, I am now recommending that mainstream investors simply purchase the FXF exchange traded notes, "CurrencyShares Swiss Franc Trust" (denominated in US dollars) through their broker. This exchange traded note uses the interest on its deposits to cover the management fees of the fund, with the result that you will receive modest interest income via this method.

Note (9 August 2008): Most global currencies happen to be weak against the US dollar right now, as the US market is presently driven by the fantasy that the US government's now $800 billion rescue of the financial system by "nationalizing" the government sponsored enterprises (Fannie Mae and Freddie Mac) and using taxpayer money to guarantee worthless bank assets will make everything "all right again." That fantasy will persist for a season, and then it will fade, as all fantasies do.

October 11, 2008: If you're interested in Swiss Franc Government Bonds, here is a recommendation from WikiAnswers. This brief note recommends EuroPacific Capital. Its C.E.O. and Chief Global Strategist, Peter Schiff, is a long-term US dollar bear who saw the present economic meltdown coming years ago. EuroPacific Capital is a secure and well-managed company, and I can certainly vouch for the reputation of Mr. Schiff, whose articles on the mismanaged US economy I have been reading for years on Safehaven.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling.

_Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2008/02/currencies-101.html

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

I'm not a currency trader, but I am a Canadian. I think the present currency trends are pretty clear.

The commodity currencies (such as the Canadian dollar) are down on the recession trade.

The commodity currencies (such as the Canadian dollar) are down on the recession trade.The (low interest) carry trade currencies (the Swiss Franc and the Japanese Yen) are up, more or less for the same reason (the unwinding of the carry trade).

A look at the charts for the Swiss Franc (XSF) and Japanese Yen (XJY) pretty well sums it up. I'm happy to hold my recently appreciated Canadian dollars (though the Toronto Gold Index has been horrible due in part to the currency trend), but if I were Swiss or Japanese now, I wouldn't buy Canadian dollars so long as recession fears are driving the market.

A look at the charts for the Swiss Franc (XSF) and Japanese Yen (XJY) pretty well sums it up. I'm happy to hold my recently appreciated Canadian dollars (though the Toronto Gold Index has been horrible due in part to the currency trend), but if I were Swiss or Japanese now, I wouldn't buy Canadian dollars so long as recession fears are driving the market. Once the focus returns to inflation (no one has paid attention to inflation since Paul Volcker temporarily resolved the problem in the early 1980s), Canadian dollars and the other resource currencies should have their next leg up, along with the precious metals. But inflation has been raging for years and nobody has paid much attention so far.

Once the focus returns to inflation (no one has paid attention to inflation since Paul Volcker temporarily resolved the problem in the early 1980s), Canadian dollars and the other resource currencies should have their next leg up, along with the precious metals. But inflation has been raging for years and nobody has paid much attention so far. So how long will it take citizens, politicians, central bankers and investors to notice that inflation is a very big problem?

So how long will it take citizens, politicians, central bankers and investors to notice that inflation is a very big problem? If we can live surrounded by inflation for as long as we already have without recognizing it for what it is, it strikes me as entirely possible that we will be able to continue ignoring it for some additional time to come. At some point, however, it will no longer be possible to live with inflation day in and day out without discerning that it is not benign. When that time comes, I predict that our thinking will change dramatically....

If we can live surrounded by inflation for as long as we already have without recognizing it for what it is, it strikes me as entirely possible that we will be able to continue ignoring it for some additional time to come. At some point, however, it will no longer be possible to live with inflation day in and day out without discerning that it is not benign. When that time comes, I predict that our thinking will change dramatically....For those interested in the Swiss Franc specifically, here are links for all my entries concerning the Swiss Franc:

1. Canadians, Buy the Swiss Franc Now!

2. The Swiss Franc Continues To Climb in Canadian Dollars.

3. My first compliment from Fleck.

4. Currencies 101.

5. Another Swiss Franc Buying Opportunity for Canadians.

6. All You Need To Know About Global Money Supply in One Place.

7. The Swiss Franc Is Still Strong.

8. Use "FXF" (CurrencyShares Swiss Franc Trust) To Buy the Swiss Franc

9. Gold is Better Than the Swiss Franc.

10. Swiss Franc Alert.

11. Gold Isn't Gaining All That Much... In Canadian Dollars!

Addendum: Many visitors to this site have enquired about how to purchase the Swiss Franc. The most direct method is simply to purchase Swiss Francs from a currency dealer. In Canada, Custom House Currency Exchange offers competitive rates. You may also wish to contact your broker about an exchange-traded fund or a Swiss Franc government bond (which would pay interest on your investment, but could be subject to decline in value even if the currency itself rises relative to other currencies). Additionally, some banks permit investors to maintain foreign currency accounts. Sophisticated investors may wish to enter this trade through purchasing futures contracts or other types of options, such as calls. Many brokers specialize in foreign currency purchases, so I suggest that you start with a broker familiar to you. As I understand it, Pamela and Mary Anne Aden at Aden Research, for example, will execute foreign currency trades for their customers. But for those who don't know how, simply purchasing the currency from a competitive currency trader (possibly your local bank, or a trader recommended by your bank) will be a good place to get started. Ideally the "spread" between the buy and ask price for the currency should be less than 4 cents on the dollar (roughly 4%). That is, you should not pay a premium of greater than 2% to purchase the currency. This being said, my own experience with currency dealers is that it is very difficult to exchange currencies in this idealized range. Our local broker's rates are much higher, for example. Never exchange currencies in large amounts at airports, hotels and other locations that are charging large premiums to provide a convenience service to travellers. Look for the best rates any time you exchange currencies!

August 5, 2008: As currency purchases at fair exchange rates are extremely difficult to obtain, I am now recommending that mainstream investors simply purchase the FXF exchange traded notes, "CurrencyShares Swiss Franc Trust" (denominated in US dollars) through their broker. This exchange traded note uses the interest on its deposits to cover the management fees of the fund, with the result that you will receive modest interest income via this method.

Note (9 August 2008): Most global currencies happen to be weak against the US dollar right now, as the US market is presently driven by the fantasy that the US government's now $800 billion rescue of the financial system by "nationalizing" the government sponsored enterprises (Fannie Mae and Freddie Mac) and using taxpayer money to guarantee worthless bank assets will make everything "all right again." That fantasy will persist for a season, and then it will fade, as all fantasies do.

In the meantime, the Swiss Franc may not have bottomed for US investors. However, I note that the Franc is holding up fine against the Canadian dollar, as both are under pressure versus the US dollar, which is presently enjoying a transient upward move due primarily to concerns about the stability of the Euro. Pamela and Mary Ann Aden advise that the market value of the Euro is presently stronger than that of the Swiss Franc. My own take is that the Swiss Franc clearly possesses superior fundamentals compared to the Euro, which relies upon the historically unproven concept of international cooperation (don't expect the cooperation of the European countries to be maintained in hard times or in crisis!).

In the meantime, the Swiss Franc may not have bottomed for US investors. However, I note that the Franc is holding up fine against the Canadian dollar, as both are under pressure versus the US dollar, which is presently enjoying a transient upward move due primarily to concerns about the stability of the Euro. Pamela and Mary Ann Aden advise that the market value of the Euro is presently stronger than that of the Swiss Franc. My own take is that the Swiss Franc clearly possesses superior fundamentals compared to the Euro, which relies upon the historically unproven concept of international cooperation (don't expect the cooperation of the European countries to be maintained in hard times or in crisis!).

October 11, 2008: If you're interested in Swiss Franc Government Bonds, here is a recommendation from WikiAnswers. This brief note recommends EuroPacific Capital. Its C.E.O. and Chief Global Strategist, Peter Schiff, is a long-term US dollar bear who saw the present economic meltdown coming years ago. EuroPacific Capital is a secure and well-managed company, and I can certainly vouch for the reputation of Mr. Schiff, whose articles on the mismanaged US economy I have been reading for years on Safehaven.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling._Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2008/02/currencies-101.html

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

No comments:

Post a Comment