28 February 2008, 10 May 2010, 8 April 2011

On only October 10, 2007, I wrote that two companies with then approximately equal market capitalizations could differ by a factor of perhaps 100 over ten years' time.

On only October 10, 2007, I wrote that two companies with then approximately equal market capitalizations could differ by a factor of perhaps 100 over ten years' time.

It is only 4-1/2 months later, so a progress observation may be premature. However, there are already interesting observations to be made.

On October 10, 2007, I compared BHP Billiton (BHP), the world's largest mining company, with an unimaginable store of physical mineral wealth still buried "in the ground" in multiple locations around the world, to Google (GOOG), an innovative company which I really like, but which I consider a will o' the wisp investment with a fragile income stream based on the thin reed of "click-based" internet advertising.

On October 10, 2007, I compared BHP Billiton (BHP), the world's largest mining company, with an unimaginable store of physical mineral wealth still buried "in the ground" in multiple locations around the world, to Google (GOOG), an innovative company which I really like, but which I consider a will o' the wisp investment with a fragile income stream based on the thin reed of "click-based" internet advertising.

I asserted that if Google falls in market capitalization and BHP rises in market capitalization, each by a factor of ten, then BHP will have 100 times the market value of Google in ten years' time.

On that day, BHP was valued by the market at $230 billion, and Google was valued at $182 billion. If you think I'm being unfair to Google in equating it to BHP in initial value, consider that in early November 2007, Google did reach a market capitalization of $234 billion - at which time its stock price had soared to $747.24.

On that day, BHP was valued by the market at $230 billion, and Google was valued at $182 billion. If you think I'm being unfair to Google in equating it to BHP in initial value, consider that in early November 2007, Google did reach a market capitalization of $234 billion - at which time its stock price had soared to $747.24.

BHP reached its so far best levels at about the same time as Google, in late October 2007, when its stock traded at $86.74 per share, placing its market value at that time at $244 billion.

BHP reached its so far best levels at about the same time as Google, in late October 2007, when its stock traded at $86.74 per share, placing its market value at that time at $244 billion.

Both stocks are down now, but, as per my prediction, Google is already down considerably more than BHP.

If I am right, BHP will continue to rise and GOOG will continue to fall, until eventually BHP will be recognized as having the market worth of 100 "Googles."

Where are we today?

BHP closed on February 27, 2007 at $75.01 per share, with a market capitalization of $210.59 billion, down modestly (13.5%) from its early November 2007 all-time highs.. Google closed yesterday at $472.86 per share, with a market capitalization of $148.18 billion, down 39.3% from its late October 2007 high of $244 billion. (Note that Google's Tuesday low of $446.85 per share - representing a market capitalization of $140.04 billion - had already taken it down $94 billion from its maximum market valuation - that is, Google has been losing about $1.5 billion per day in market value since mid-November!)

BHP closed on February 27, 2007 at $75.01 per share, with a market capitalization of $210.59 billion, down modestly (13.5%) from its early November 2007 all-time highs.. Google closed yesterday at $472.86 per share, with a market capitalization of $148.18 billion, down 39.3% from its late October 2007 high of $244 billion. (Note that Google's Tuesday low of $446.85 per share - representing a market capitalization of $140.04 billion - had already taken it down $94 billion from its maximum market valuation - that is, Google has been losing about $1.5 billion per day in market value since mid-November!)

If my analysis is accurate, of course, Google's so-far 39% fall will be only the beginning of a long decline into the 21st century. Only an additional 51% need be lopped off of Google's maximum market capitalization to reach the levels I have suggested as a modest ten-year price target.

If my analysis is accurate, of course, Google's so-far 39% fall will be only the beginning of a long decline into the 21st century. Only an additional 51% need be lopped off of Google's maximum market capitalization to reach the levels I have suggested as a modest ten-year price target.

Again, I don't bear ill will towards Google. I just don't see the company as having great leverage to the market based on a business model of generating profits on a long-term basis by selling internet advertising to display to individuals who use the company's innovative products.

In short, at its present $211 billion market capitalization, BHP is a company that is on its way up for many years, and probably many decades, to come. Could BHP be a $2 trillion company in ten years' time? Maybe.....

In short, at its present $211 billion market capitalization, BHP is a company that is on its way up for many years, and probably many decades, to come. Could BHP be a $2 trillion company in ten years' time? Maybe.....

And Google? On the move as well, but downwards in a secular trend for as far as the eye can see....

Could Google be a $20 billion company in 9-1/2 years' time? It's not hard to imagine. $20 billion is still quite a rich valuation, and Google might struggle to maintain its market worth at this level through the likely trials and tribulations of the next ten years.

Disclaimer: I do not hold shares of either Google or BHP Billiton, nor do I trade in either stock or its options or its futures in any way. This statement, however, does not preclude the possibility that I may do so in future.

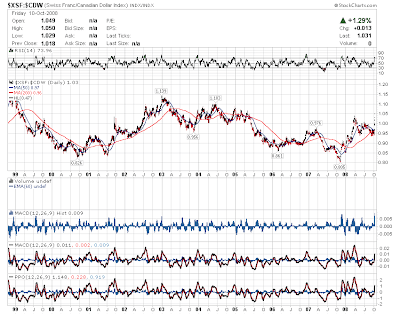

10 May 2010: Here is a brief update on the BHP-Google contrast. The chart below is a ratio chart, showing the value of BHP stock, divided by the price of Google stock.

There can be no argument, I think, that the trend is clear. BHP is obviously outperforming Google. However, BHP is weak at this time for two reasons. (1) Both BHP and Google are negatively affected by the Greek crisis and the associated European contagion. (2) The Australian prime minister has proposed to add an additional and onerous 40% production tax on all Australian mining companies. This idea is so ludicrous (is Australia truly ready to become a pariah nation along with Venezuela, Bolivia or Zimbabwe?) that I do not think it will ever be enacted as legislation. However, the uncertainty is certainly exerting a downward drag on Australia-based BHP at this time....

There can be no argument, I think, that the trend is clear. BHP is obviously outperforming Google. However, BHP is weak at this time for two reasons. (1) Both BHP and Google are negatively affected by the Greek crisis and the associated European contagion. (2) The Australian prime minister has proposed to add an additional and onerous 40% production tax on all Australian mining companies. This idea is so ludicrous (is Australia truly ready to become a pariah nation along with Venezuela, Bolivia or Zimbabwe?) that I do not think it will ever be enacted as legislation. However, the uncertainty is certainly exerting a downward drag on Australia-based BHP at this time....

8 April 2011: OK. Google is back up to a market capitalization of $186 billion (from $148 billion on February 28, 2008). Looking good. However, BHP has now soared from $211 billion to $282 billion.

The differential now makes BHP worth 50% more than Google. Honestly, I don't WANT Google (who is my free blog host) to lose 99% of its valuation relative to BHP. But so far, the trend is as predicted, though a long way from plus 10x and minus 10x....

The differential now makes BHP worth 50% more than Google. Honestly, I don't WANT Google (who is my free blog host) to lose 99% of its valuation relative to BHP. But so far, the trend is as predicted, though a long way from plus 10x and minus 10x....

But there are 6-1/2 more years to go. So, let's keep watching!

But there are 6-1/2 more years to go. So, let's keep watching!

_

Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2008/02/

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

On only October 10, 2007, I wrote that two companies with then approximately equal market capitalizations could differ by a factor of perhaps 100 over ten years' time.

On only October 10, 2007, I wrote that two companies with then approximately equal market capitalizations could differ by a factor of perhaps 100 over ten years' time.It is only 4-1/2 months later, so a progress observation may be premature. However, there are already interesting observations to be made.

On October 10, 2007, I compared BHP Billiton (BHP), the world's largest mining company, with an unimaginable store of physical mineral wealth still buried "in the ground" in multiple locations around the world, to Google (GOOG), an innovative company which I really like, but which I consider a will o' the wisp investment with a fragile income stream based on the thin reed of "click-based" internet advertising.

On October 10, 2007, I compared BHP Billiton (BHP), the world's largest mining company, with an unimaginable store of physical mineral wealth still buried "in the ground" in multiple locations around the world, to Google (GOOG), an innovative company which I really like, but which I consider a will o' the wisp investment with a fragile income stream based on the thin reed of "click-based" internet advertising.I asserted that if Google falls in market capitalization and BHP rises in market capitalization, each by a factor of ten, then BHP will have 100 times the market value of Google in ten years' time.

On that day, BHP was valued by the market at $230 billion, and Google was valued at $182 billion. If you think I'm being unfair to Google in equating it to BHP in initial value, consider that in early November 2007, Google did reach a market capitalization of $234 billion - at which time its stock price had soared to $747.24.

On that day, BHP was valued by the market at $230 billion, and Google was valued at $182 billion. If you think I'm being unfair to Google in equating it to BHP in initial value, consider that in early November 2007, Google did reach a market capitalization of $234 billion - at which time its stock price had soared to $747.24. BHP reached its so far best levels at about the same time as Google, in late October 2007, when its stock traded at $86.74 per share, placing its market value at that time at $244 billion.

BHP reached its so far best levels at about the same time as Google, in late October 2007, when its stock traded at $86.74 per share, placing its market value at that time at $244 billion. Both stocks are down now, but, as per my prediction, Google is already down considerably more than BHP.

If I am right, BHP will continue to rise and GOOG will continue to fall, until eventually BHP will be recognized as having the market worth of 100 "Googles."

Where are we today?

BHP closed on February 27, 2007 at $75.01 per share, with a market capitalization of $210.59 billion, down modestly (13.5%) from its early November 2007 all-time highs.. Google closed yesterday at $472.86 per share, with a market capitalization of $148.18 billion, down 39.3% from its late October 2007 high of $244 billion. (Note that Google's Tuesday low of $446.85 per share - representing a market capitalization of $140.04 billion - had already taken it down $94 billion from its maximum market valuation - that is, Google has been losing about $1.5 billion per day in market value since mid-November!)

BHP closed on February 27, 2007 at $75.01 per share, with a market capitalization of $210.59 billion, down modestly (13.5%) from its early November 2007 all-time highs.. Google closed yesterday at $472.86 per share, with a market capitalization of $148.18 billion, down 39.3% from its late October 2007 high of $244 billion. (Note that Google's Tuesday low of $446.85 per share - representing a market capitalization of $140.04 billion - had already taken it down $94 billion from its maximum market valuation - that is, Google has been losing about $1.5 billion per day in market value since mid-November!) If my analysis is accurate, of course, Google's so-far 39% fall will be only the beginning of a long decline into the 21st century. Only an additional 51% need be lopped off of Google's maximum market capitalization to reach the levels I have suggested as a modest ten-year price target.

If my analysis is accurate, of course, Google's so-far 39% fall will be only the beginning of a long decline into the 21st century. Only an additional 51% need be lopped off of Google's maximum market capitalization to reach the levels I have suggested as a modest ten-year price target.Again, I don't bear ill will towards Google. I just don't see the company as having great leverage to the market based on a business model of generating profits on a long-term basis by selling internet advertising to display to individuals who use the company's innovative products.

In short, at its present $211 billion market capitalization, BHP is a company that is on its way up for many years, and probably many decades, to come. Could BHP be a $2 trillion company in ten years' time? Maybe.....

In short, at its present $211 billion market capitalization, BHP is a company that is on its way up for many years, and probably many decades, to come. Could BHP be a $2 trillion company in ten years' time? Maybe.....And Google? On the move as well, but downwards in a secular trend for as far as the eye can see....

Could Google be a $20 billion company in 9-1/2 years' time? It's not hard to imagine. $20 billion is still quite a rich valuation, and Google might struggle to maintain its market worth at this level through the likely trials and tribulations of the next ten years.

Disclaimer: I do not hold shares of either Google or BHP Billiton, nor do I trade in either stock or its options or its futures in any way. This statement, however, does not preclude the possibility that I may do so in future.

10 May 2010: Here is a brief update on the BHP-Google contrast. The chart below is a ratio chart, showing the value of BHP stock, divided by the price of Google stock.

There can be no argument, I think, that the trend is clear. BHP is obviously outperforming Google. However, BHP is weak at this time for two reasons. (1) Both BHP and Google are negatively affected by the Greek crisis and the associated European contagion. (2) The Australian prime minister has proposed to add an additional and onerous 40% production tax on all Australian mining companies. This idea is so ludicrous (is Australia truly ready to become a pariah nation along with Venezuela, Bolivia or Zimbabwe?) that I do not think it will ever be enacted as legislation. However, the uncertainty is certainly exerting a downward drag on Australia-based BHP at this time....

There can be no argument, I think, that the trend is clear. BHP is obviously outperforming Google. However, BHP is weak at this time for two reasons. (1) Both BHP and Google are negatively affected by the Greek crisis and the associated European contagion. (2) The Australian prime minister has proposed to add an additional and onerous 40% production tax on all Australian mining companies. This idea is so ludicrous (is Australia truly ready to become a pariah nation along with Venezuela, Bolivia or Zimbabwe?) that I do not think it will ever be enacted as legislation. However, the uncertainty is certainly exerting a downward drag on Australia-based BHP at this time....8 April 2011: OK. Google is back up to a market capitalization of $186 billion (from $148 billion on February 28, 2008). Looking good. However, BHP has now soared from $211 billion to $282 billion.

The differential now makes BHP worth 50% more than Google. Honestly, I don't WANT Google (who is my free blog host) to lose 99% of its valuation relative to BHP. But so far, the trend is as predicted, though a long way from plus 10x and minus 10x....

The differential now makes BHP worth 50% more than Google. Honestly, I don't WANT Google (who is my free blog host) to lose 99% of its valuation relative to BHP. But so far, the trend is as predicted, though a long way from plus 10x and minus 10x.... But there are 6-1/2 more years to go. So, let's keep watching!

But there are 6-1/2 more years to go. So, let's keep watching!_

Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2008/02/

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection