15 July 2008

Thank you Mike Hewitt!

Thank you Mike Hewitt!

I have written fervently and often that secular trends are the most important factor in investing, and that excess (monetary) liquidity is at the root of our most fundamental social and economic evils.

Almost no one ever talks about either of these factors, despite their driving influence beneath the surface of global political and economic events.

Now Mike Hewitt has pulled together all you need to know about the money supply of the world's major economies in one place.

What are the money supply levels in each leading nation? What is the rate of money supply growth in each country? How does each nation compare as to its total money supply and its level of money supply growth?

What are the money supply levels in each leading nation? What is the rate of money supply growth in each country? How does each nation compare as to its total money supply and its level of money supply growth?

Mike Hewitt has answered all these questions for you in a single article.

Click here for his very valuable interpretation of this information.

And... here are the summary tables and charts to get you started....

By the way, M3 is the best measure of money supply, as it is the most inclusive - leading one to wonder, perhaps - why the US government has stopped publishing this figure (obfuscation is the last refuge of the scoundrel?)!!!

First - what is the money supply (in US dollar terms) in each leading nation?

First - what is the money supply (in US dollar terms) in each leading nation?

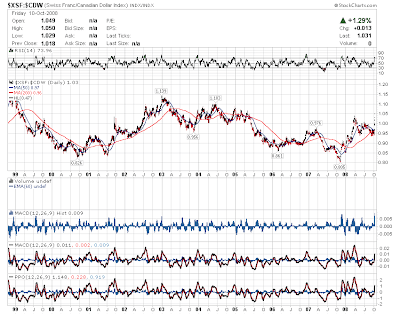

Here is the same information in graphical form:

Next, what is the rate of money supply growth in each country?

Again, the same information in graphical form:

Here are a few things to remember....

Here are a few things to remember....

Money supply is not wealth. If the growth in money supply exceeds a nation's level of productivity growth, the addition to money supply is merely inflationary, devaluing the currency and fomenting social instability. Productivity growth varies considerably from country to country.

Money supply is not wealth. If the growth in money supply exceeds a nation's level of productivity growth, the addition to money supply is merely inflationary, devaluing the currency and fomenting social instability. Productivity growth varies considerably from country to country.

For example, Chinese productivity is growing much more rapidly than is that of the US, so the Chinese can get away with a higher rate of increase in the money supply (though the Chinese money supply is nonetheless increasing too rapidly - spelling danger for the Chinese economy - because the Chinese have tied their currency to the US dollar to maintain a stable level of exports to the US).

Note that there are only two "good guys" here - Switzerland and Japan.

Note that there are only two "good guys" here - Switzerland and Japan.

The Swiss are controlling money supply growth because they are fiscally prudent and responsible.

That is why the Swiss Franc has remained a sound investment over many generations.

The Japanese story is a little different.

Prior to the US internet/equity and real-estate/debt bubbles, the Japanese ran the biggest real-estate and debt bubble in world history in the 1980s. The bubble caught up to the Japanese, forcing their economy into deflation.

Prior to the US internet/equity and real-estate/debt bubbles, the Japanese ran the biggest real-estate and debt bubble in world history in the 1980s. The bubble caught up to the Japanese, forcing their economy into deflation.

In short, the Japanese are "good guys" on the money front because they now have to be.

The Swiss are good guys because they know how to manage money wisely.

Therefore, the Swiss Franc remains a wise investment, though in my opinion, as you have heard many times before on this site, gold and silver are better investments still! (My own comments on the Swiss Franc in other posts start here.)

Therefore, the Swiss Franc remains a wise investment, though in my opinion, as you have heard many times before on this site, gold and silver are better investments still! (My own comments on the Swiss Franc in other posts start here.)

By the way, I'm not a precious metals investor because I'm especially enamoured of metals.

I invest in gold and silver because the irresponsible inflationary policies of every major global economic power - apart from Japan and Switzerland - are forcing my hand.

In essence, inflationary monetary policy eventually devalues every product save the precious metals.

Why?

Because gold is a reliable store of value when all other currencies are inflating excessively. It's that simple.

Because gold is a reliable store of value when all other currencies are inflating excessively. It's that simple.

When tough times - much tougher than now, by the way - eventually force world governments to return to conservative financial practices, I'll be back investing in the common shares of sound business enterprises.

Unfortunately, current international government and central bank practices are wrecking the economic climate for business everywhere in the world, driving the international business scene into recession, and possibly into depression.

This is what drives secular trends.

This is what drives secular trends.

And investment is a fruitless exercise without analysis and consideration of the present secular trend that is dominating economic life.

What, by the way, is our dominant secular trend at this time?

It's safe to say that the answer to this question is that the current secular trend is propelled by the unwinding of speculation and excessive risk.

That is, risk and speculation have taken us as far as they can take us. We are now at a financial dead end, and the answer to our present quandary is to seek out investment sectors that are sheltered from risk, speculation and excesses of all kinds.

That is, risk and speculation have taken us as far as they can take us. We are now at a financial dead end, and the answer to our present quandary is to seek out investment sectors that are sheltered from risk, speculation and excesses of all kinds.

Gold and silver - and the Swiss Franc and the Japanese Yen - are all that are left for now....

(By the way, Mr. Hewitt has also published a comprehensive inventory of the world's failed currencies here. Should the US dollar eventually fail, it will constitute the third occasion that a US currency has lost all of its value.)

For those interested in the Swiss Franc specifically, here are links for all my entries concerning the Swiss Franc:

1. Canadians, Buy the Swiss Franc Now!

2. The Swiss Franc Continues To Climb in Canadian Dollars.

3. My first compliment from Fleck.

4. Currencies 101.

5. Another Swiss Franc Buying Opportunity for Canadians.

6. All You Need To Know About Global Money Supply in One Place.

7. The Swiss Franc Is Still Strong.

8. Use "FXF" (CurrencyShares Swiss Franc Trust) To Buy the Swiss Franc

9. Gold is Better Than the Swiss Franc.

Addendum: Many visitors to this site have enquired about how to purchase the Swiss Franc. The most direct method is simply to purchase Swiss Francs from a currency dealer. In Canada, Custom House Currency Exchange offers competitive rates. You may also wish to contact your broker about an exchange-traded fund or a Swiss Franc government bond (which would pay interest on your investment, but could be subject to decline in value even if the currency itself rises relative to other currencies). Additionally, some banks permit investors to maintain foreign currency accounts. Sophisticated investors may wish to enter this trade through purchasing futures contracts or other types of options, such as calls. Many brokers specialize in foreign currency purchases, so I suggest that you start with a broker familiar to you. As I understand it, Pamela and Mary Anne Aden at Aden Research, for example, will execute foreign currency trades for their customers. But for those who don't know how, simply purchasing the currency from a competitive currency trader (possibly your local bank, or a trader recommended by your bank) will be a good place to get started. Ideally the "spread" between the buy and ask price for the currency should be less than 4 cents on the dollar (roughly 4%). That is, you should not pay a premium of greater than 2% to purchase the currency. This being said, my own experience with currency dealers is that it is very difficult to exchange currencies in this idealized range. Our local broker's rates are much higher, for example. Never exchange currencies in large amounts at airports, hotels and other locations that are charging large premiums to provide a convenience service to travellers. Look for the best rates any time you exchange currencies!

August 5, 2008: As currency purchases at fair exchange rates are extremely difficult to obtain, I am now recommending that mainstream investors simply purchase the FXF exchange traded notes, "CurrencyShares Swiss Franc Trust" (denominated in US dollars) through their broker. This exchange traded note uses the interest on its deposits to cover the management fees of the fund, with the result that you will receive modest interest income via this method.

Note (9 August 2008): Most global currencies happen to be weak against the US dollar right now, as the US market is presently driven by the fantasy that the US government's now $800 billion rescue of the financial system by "nationalizing" the government sponsored enterprises (Fannie Mae and Freddie Mac) and using taxpayer money to guarantee worthless bank assets will make everything "all right again." That fantasy will persist for a season, and then it will fade, as all fantasies do.

October 11, 2008: If you're interested in Swiss Franc Government Bonds, here is a recommendation from WikiAnswers. This brief note recommends EuroPacific Capital. Its C.E.O. and Chief Global Strategist, Peter Schiff, is a long-term US dollar bear who saw the present economic meltdown coming years ago. EuroPacific Capital is a secure and well-managed company, and I can certainly vouch for the reputation of Mr. Schiff, whose articles on the mismanaged US economy I have been reading for years on Safehaven.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling.

_Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2008/07/all-you-need-to-know-about-global-money.html

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

Thank you Mike Hewitt!

Thank you Mike Hewitt! I have written fervently and often that secular trends are the most important factor in investing, and that excess (monetary) liquidity is at the root of our most fundamental social and economic evils.

Almost no one ever talks about either of these factors, despite their driving influence beneath the surface of global political and economic events.

Now Mike Hewitt has pulled together all you need to know about the money supply of the world's major economies in one place.

What are the money supply levels in each leading nation? What is the rate of money supply growth in each country? How does each nation compare as to its total money supply and its level of money supply growth?

What are the money supply levels in each leading nation? What is the rate of money supply growth in each country? How does each nation compare as to its total money supply and its level of money supply growth? Mike Hewitt has answered all these questions for you in a single article.

Click here for his very valuable interpretation of this information.

And... here are the summary tables and charts to get you started....

By the way, M3 is the best measure of money supply, as it is the most inclusive - leading one to wonder, perhaps - why the US government has stopped publishing this figure (obfuscation is the last refuge of the scoundrel?)!!!

First - what is the money supply (in US dollar terms) in each leading nation?

First - what is the money supply (in US dollar terms) in each leading nation?| Name of Country | M0 (US$bn) | M1 | M2 (US$bn) | M3 (US$bn) | Exchange | Date |

| Australia | 37.7 | 208.0 | 459.3 | 962.0 | 1.0426 AUD | Apr-08 |

| Brazil | 56.3 | 114.3 | 519.2 | 1,060.8 | 1.6141 BRL | May-08 |

| Canada | 49.0 | 386.6 | 800.1 | 1,228.6 | 1.0114 CAD | May-08 |

| China | 440.5 | 2,236.2 | 6,363.0 | N/A | 6.8552 CNY | May-08 |

| Denmark | 10.6 | 162.6 | 211.7 | 237.3 | 4.7401 DKK | Feb-08 |

| E.U. | 1,013.4 | 6,072.7 | 12,039.9 | 14,197.4 | 0.6355 EUR | May-08 |

| India | 139.9 | 256.6 | 947.9 | 949.1 | 43.200 INR | Jun-08 |

| Indonesia | 16.6 | 39.7 | 151.9 | N/A | 9174.3 IDR | May-07 |

| Japan | 680.1 | 3,641.4 | 6,901.6 | 11,367.9 | 107.01 JPY | Apr-08 |

| Kuwait | 2.7 | 19.9 | 80.2 | 80.2 | 0.2667 KWD | May-08 |

| Mexico | 38.1 | 132.0 | 575.0 | 606.4 | 10.310 MXN | Apr-08 |

| Norway | 8.6 | 144.3 | 281.9 | N/A | 5.1225 NOK | Apr-08 |

| Poland | 47.4 | 165.1 | 283.0 | 288.2 | 2.0822 PLN | May-08 |

| Russia | 153.8 | N/A | 570.1 | N/A | 23.412 RUB | Apr-08 |

| Saudi Arabia | 19.8 | 111.6 | 187.2 | 224.9 | 3.7547 SAR | May-08 |

| Singapore | 12.7 | 52.6 | 233.9 | 240.8 | 1.3607 SGD | Apr-08 |

| South Africa | 13.9 | 96.2 | 192.1 | 235.2 | 7.7208 ZAR | May-08 |

| South Korea | 56.7 | 300.7 | 1,350.1 | 2,163.5 | 1000.6 KRW | Apr-08 |

| Sweden | 16.1 | 222.6 | N/A | 315.4 | 6.0088 SEK | Dec-07 |

| Switzerland | 35.4 | 257.3 | 421.9 | 609.5 | 1.0298 CHF | May-08 |

| Turkey | 22.8 | 45.2 | 199.7 | 215.5 | 1.2228 TRY | Jun-08 |

| U.A.E. | 7.1 | 49.4 | 154.0 | 189.5 | 3.6742 AED | Dec-07 |

| U.K. | 99.1 | 1,990.7 | 3,291.1 | 3,882.3 | 0.5055 GBP | May-08 |

| U.S. | 832.6 | 1,388.3 | 7,688.1 | 13,800.0 | 1.0000 USD | Jun-08 |

| Venezuela | 6.2 | 43.7 | 71.9 | 71.9 | 2.1522 VEF | May-08 |

Here is the same information in graphical form:

Next, what is the rate of money supply growth in each country?

| Name of Country | M0 (Y/Y%) | M1 (Y/Y%) | M2 (Y/Y%) | M3 (Y/Y%) | Date Taken |

| Australia | 5.2% | 3.3% | 16.9% | 20.4% | Apr-08 |

| Brazil | 21.1% | 16.8% | 26.2% | 17.4% | May-08 |

| Canada | 3.4% | 7.9% | 8.8% | 13.2% | May-08 |

| China | 12.9% | 17.9% | 18.1% | N/A | May-08 |

| Denmark | N/A | 10.5% | 18.5% | 22.3% | Feb-08 |

| E.U. | 7.5% | 2.3% | 10.1% | 10.5% | May-08 |

| India | 19.3% | 19.8% | 21.8% | 22.5% | Jun-08 |

| Indonesia | 21.5% | 28.1% | 14.9% | N/A | May-07 |

| Japan | 1.86% | -1.22% | 0.71% | 0.92% | Apr-08 |

| Kuwait | 10.8% | 28.2% | 23.0% | 23.0% | May-08 |

| Mexico | 9.2% | 10.2% | 12.0% | 14.1% | Apr-08 |

| Norway | 10.7% | 7.6% | 14.0% | N/A | Apr-08 |

| Poland | 5.2% | 17.3% | 16.7% | 15.1% | May-08 |

| Russia | 25.9% | N/A | 33.4% | N/A | Apr-08 |

| Saudi Arabia | 13.0% | 27.0% | 21.4% | 21.6% | May-08 |

| Singapore | 9.7% | 29.0% | 11.9% | 12.4% | Apr-08 |

| South Africa | 14.1% | 12.4% | 19.5% | 20.9% | May-08 |

| South Korea | N/A | -0.6% | 16.3% | 14.6% | Apr-08 |

| Sweden | 0.5% | 10.7% | N/A | 16.4% | Dec-07 |

| Switzerland | 2.1% | -2.0% | -4.5% | 2.6% | May-08 |

| Turkey | 20.0% | 20.1% | 21.5% | 21.1% | Jun-08 |

| U.A.E. | 18.8% | 51.4% | 41.7% | 37.4% | Dec-07 |

| U.K. | 5.7% | 16.0% | 12.6% | 13.8% | May-08 |

| U.S. | 1.6% | 1.5% | 6.0% | 18.8% | Jun-08 |

| Venezuela | 1.6% | 1.5% | 6.0% | 18.8% | May-08 |

Again, the same information in graphical form:

Here are a few things to remember....

Here are a few things to remember....  Money supply is not wealth. If the growth in money supply exceeds a nation's level of productivity growth, the addition to money supply is merely inflationary, devaluing the currency and fomenting social instability. Productivity growth varies considerably from country to country.

Money supply is not wealth. If the growth in money supply exceeds a nation's level of productivity growth, the addition to money supply is merely inflationary, devaluing the currency and fomenting social instability. Productivity growth varies considerably from country to country.For example, Chinese productivity is growing much more rapidly than is that of the US, so the Chinese can get away with a higher rate of increase in the money supply (though the Chinese money supply is nonetheless increasing too rapidly - spelling danger for the Chinese economy - because the Chinese have tied their currency to the US dollar to maintain a stable level of exports to the US).

Note that there are only two "good guys" here - Switzerland and Japan.

Note that there are only two "good guys" here - Switzerland and Japan. The Swiss are controlling money supply growth because they are fiscally prudent and responsible.

That is why the Swiss Franc has remained a sound investment over many generations.

The Japanese story is a little different.

Prior to the US internet/equity and real-estate/debt bubbles, the Japanese ran the biggest real-estate and debt bubble in world history in the 1980s. The bubble caught up to the Japanese, forcing their economy into deflation.

Prior to the US internet/equity and real-estate/debt bubbles, the Japanese ran the biggest real-estate and debt bubble in world history in the 1980s. The bubble caught up to the Japanese, forcing their economy into deflation.In short, the Japanese are "good guys" on the money front because they now have to be.

The Swiss are good guys because they know how to manage money wisely.

Therefore, the Swiss Franc remains a wise investment, though in my opinion, as you have heard many times before on this site, gold and silver are better investments still! (My own comments on the Swiss Franc in other posts start here.)

Therefore, the Swiss Franc remains a wise investment, though in my opinion, as you have heard many times before on this site, gold and silver are better investments still! (My own comments on the Swiss Franc in other posts start here.)By the way, I'm not a precious metals investor because I'm especially enamoured of metals.

I invest in gold and silver because the irresponsible inflationary policies of every major global economic power - apart from Japan and Switzerland - are forcing my hand.

In essence, inflationary monetary policy eventually devalues every product save the precious metals.

Why?

Because gold is a reliable store of value when all other currencies are inflating excessively. It's that simple.

Because gold is a reliable store of value when all other currencies are inflating excessively. It's that simple. When tough times - much tougher than now, by the way - eventually force world governments to return to conservative financial practices, I'll be back investing in the common shares of sound business enterprises.

Unfortunately, current international government and central bank practices are wrecking the economic climate for business everywhere in the world, driving the international business scene into recession, and possibly into depression.

This is what drives secular trends.

This is what drives secular trends.And investment is a fruitless exercise without analysis and consideration of the present secular trend that is dominating economic life.

What, by the way, is our dominant secular trend at this time?

It's safe to say that the answer to this question is that the current secular trend is propelled by the unwinding of speculation and excessive risk.

That is, risk and speculation have taken us as far as they can take us. We are now at a financial dead end, and the answer to our present quandary is to seek out investment sectors that are sheltered from risk, speculation and excesses of all kinds.

That is, risk and speculation have taken us as far as they can take us. We are now at a financial dead end, and the answer to our present quandary is to seek out investment sectors that are sheltered from risk, speculation and excesses of all kinds. Gold and silver - and the Swiss Franc and the Japanese Yen - are all that are left for now....

(By the way, Mr. Hewitt has also published a comprehensive inventory of the world's failed currencies here. Should the US dollar eventually fail, it will constitute the third occasion that a US currency has lost all of its value.)

For those interested in the Swiss Franc specifically, here are links for all my entries concerning the Swiss Franc:

1. Canadians, Buy the Swiss Franc Now!

2. The Swiss Franc Continues To Climb in Canadian Dollars.

3. My first compliment from Fleck.

4. Currencies 101.

5. Another Swiss Franc Buying Opportunity for Canadians.

6. All You Need To Know About Global Money Supply in One Place.

7. The Swiss Franc Is Still Strong.

8. Use "FXF" (CurrencyShares Swiss Franc Trust) To Buy the Swiss Franc

9. Gold is Better Than the Swiss Franc.

Addendum: Many visitors to this site have enquired about how to purchase the Swiss Franc. The most direct method is simply to purchase Swiss Francs from a currency dealer. In Canada, Custom House Currency Exchange offers competitive rates. You may also wish to contact your broker about an exchange-traded fund or a Swiss Franc government bond (which would pay interest on your investment, but could be subject to decline in value even if the currency itself rises relative to other currencies). Additionally, some banks permit investors to maintain foreign currency accounts. Sophisticated investors may wish to enter this trade through purchasing futures contracts or other types of options, such as calls. Many brokers specialize in foreign currency purchases, so I suggest that you start with a broker familiar to you. As I understand it, Pamela and Mary Anne Aden at Aden Research, for example, will execute foreign currency trades for their customers. But for those who don't know how, simply purchasing the currency from a competitive currency trader (possibly your local bank, or a trader recommended by your bank) will be a good place to get started. Ideally the "spread" between the buy and ask price for the currency should be less than 4 cents on the dollar (roughly 4%). That is, you should not pay a premium of greater than 2% to purchase the currency. This being said, my own experience with currency dealers is that it is very difficult to exchange currencies in this idealized range. Our local broker's rates are much higher, for example. Never exchange currencies in large amounts at airports, hotels and other locations that are charging large premiums to provide a convenience service to travellers. Look for the best rates any time you exchange currencies!

August 5, 2008: As currency purchases at fair exchange rates are extremely difficult to obtain, I am now recommending that mainstream investors simply purchase the FXF exchange traded notes, "CurrencyShares Swiss Franc Trust" (denominated in US dollars) through their broker. This exchange traded note uses the interest on its deposits to cover the management fees of the fund, with the result that you will receive modest interest income via this method.

Note (9 August 2008): Most global currencies happen to be weak against the US dollar right now, as the US market is presently driven by the fantasy that the US government's now $800 billion rescue of the financial system by "nationalizing" the government sponsored enterprises (Fannie Mae and Freddie Mac) and using taxpayer money to guarantee worthless bank assets will make everything "all right again." That fantasy will persist for a season, and then it will fade, as all fantasies do.

In the meantime, the Swiss Franc may not have bottomed for US investors. However, I note that the Franc is holding up fine against the Canadian dollar, as both are under pressure versus the US dollar, which is presently enjoying a transient upward move due primarily to concerns about the stability of the Euro. Pamela and Mary Ann Aden advise that the market value of the Euro is presently stronger than that of the Swiss Franc. My own take is that the Swiss Franc clearly possesses superior fundamentals compared to the Euro, which relies upon the historically unproven concept of international cooperation (don't expect the cooperation of the European countries to be maintained in hard times or in crisis!).

In the meantime, the Swiss Franc may not have bottomed for US investors. However, I note that the Franc is holding up fine against the Canadian dollar, as both are under pressure versus the US dollar, which is presently enjoying a transient upward move due primarily to concerns about the stability of the Euro. Pamela and Mary Ann Aden advise that the market value of the Euro is presently stronger than that of the Swiss Franc. My own take is that the Swiss Franc clearly possesses superior fundamentals compared to the Euro, which relies upon the historically unproven concept of international cooperation (don't expect the cooperation of the European countries to be maintained in hard times or in crisis!).

October 11, 2008: If you're interested in Swiss Franc Government Bonds, here is a recommendation from WikiAnswers. This brief note recommends EuroPacific Capital. Its C.E.O. and Chief Global Strategist, Peter Schiff, is a long-term US dollar bear who saw the present economic meltdown coming years ago. EuroPacific Capital is a secure and well-managed company, and I can certainly vouch for the reputation of Mr. Schiff, whose articles on the mismanaged US economy I have been reading for years on Safehaven.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling.

While I am currently recommending gold as a superior store of value to the Swiss Franc, gold trades as both a commodity and a currency, with the result that its market price is much more volatile. If you are a long-term buy-and-hold investor, gold will certainly outperform the Swiss Franc as a long-term store of value. But if you don't like $100 price moves in a day (gold has had two such moves in the past month - including only yesterday!), then holding the Swiss Franc may prove less unsettling._Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2008/07/all-you-need-to-know-about-global-money.html

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

No comments:

Post a Comment