22 October 2009

It's no secret that most investors - including "trained" professionals - miss most bull markets.

It's no secret that most investors - including "trained" professionals - miss most bull markets.

If you've ever observed the bull riders at a rodeo, this will give you a pretty good idea of why we call them bull markets. They buck and kick to throw their riders off, and then they trample them underfoot.

I hear some readers asking, "Why are you saying this? Don't bull markets rise by definition?"

Yes, of course they do, but as has often been observed, bull markets inevitably "climb a wall of worry."

By way of contrast, bear markets - those in decline - drift down in a miasma of complacency. This dominant mood of bear market complacency, in turn, is punctuated by episodes of panic, which are then relieved by "dead cat bounces." These often lengthy "bounces" reassure present holders to stay the course, and lure holdouts to jump back in.

For our instruction, the "SPTGD" Toronto gold index is presently offering a textbook example of the kind of psychological angst that characterizes bull markets. Note the quick run-ups in the very first days of September and October 2009, followed by a relentless downward drift in each case. Note also the lower high in October, compared to the early September high. That is, if you had "known" what the market was going to do, you could have bought at the September 1, 2009 low, and sold at the September 4, 2009 intraday high - and you'd still be substantially better off than if you had held from September 1 through to the present.

For our instruction, the "SPTGD" Toronto gold index is presently offering a textbook example of the kind of psychological angst that characterizes bull markets. Note the quick run-ups in the very first days of September and October 2009, followed by a relentless downward drift in each case. Note also the lower high in October, compared to the early September high. That is, if you had "known" what the market was going to do, you could have bought at the September 1, 2009 low, and sold at the September 4, 2009 intraday high - and you'd still be substantially better off than if you had held from September 1 through to the present.

Unlike bear market declines, where rare but rapid downward moves are "cascading" or "waterfall" like, bull market declines are lengthy, persistent, and at the end often harrowing, though usually in accord with a well-defined "declining wedge" pattern. The declining wedge may run sideways, as was recently seen in iShares Gold Trust (GLD), just prior to the September 2, 2009 upside breakout in the gold price:

Unlike bear market declines, where rare but rapid downward moves are "cascading" or "waterfall" like, bull market declines are lengthy, persistent, and at the end often harrowing, though usually in accord with a well-defined "declining wedge" pattern. The declining wedge may run sideways, as was recently seen in iShares Gold Trust (GLD), just prior to the September 2, 2009 upside breakout in the gold price:

Or the wedge may run relentlessly downwards, as illustrated by this classic 1998-99 chart of Freeport-McMoran Copper and Gold (FCX), which occurred at the first "bottom" point of the 1999-2001 "double bottom," which in turn concluded the 21-year bear market in gold and commodities (including copper), which had persisted from 1980-2001:

Or the wedge may run relentlessly downwards, as illustrated by this classic 1998-99 chart of Freeport-McMoran Copper and Gold (FCX), which occurred at the first "bottom" point of the 1999-2001 "double bottom," which in turn concluded the 21-year bear market in gold and commodities (including copper), which had persisted from 1980-2001:

As a point of interest, declining or "falling" wedges are paradoxically more bullish than ascending wedges, as can be seen in this illustration of Ann Taylor Stores' stock price in 1999. Note that today, 10 years later, this great company's stock is presently trading in a lower range than it did in 1999, though Ann Taylor Stores eventually recovered from its 1999-2000 decline to rise as high as $45.15 in 2006:

As a point of interest, declining or "falling" wedges are paradoxically more bullish than ascending wedges, as can be seen in this illustration of Ann Taylor Stores' stock price in 1999. Note that today, 10 years later, this great company's stock is presently trading in a lower range than it did in 1999, though Ann Taylor Stores eventually recovered from its 1999-2000 decline to rise as high as $45.15 in 2006:

Let us direct further attention to the market's present behaviour. On Wednesday, September 2, 2009, gold broke out of its previous trading range, quickly ascending to new highs, and then moving on to its current record highs, as can be seen below:

Let us direct further attention to the market's present behaviour. On Wednesday, September 2, 2009, gold broke out of its previous trading range, quickly ascending to new highs, and then moving on to its current record highs, as can be seen below:

Take into consideration that the record highs are so far only in US dollars, as Canadian dollar gold peaked at $1258 in February of this year (and I certainly expect Canadian dollar gold to leave the $1258 level behind before too many more months have gone by)....

Take into consideration that the record highs are so far only in US dollars, as Canadian dollar gold peaked at $1258 in February of this year (and I certainly expect Canadian dollar gold to leave the $1258 level behind before too many more months have gone by)....

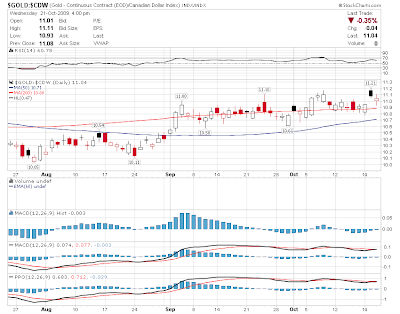

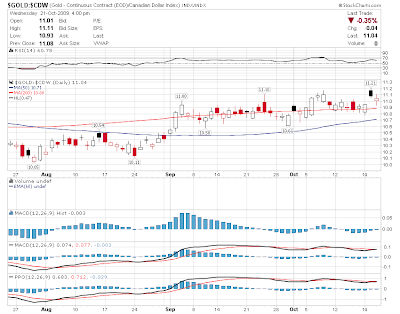

A close-up view of Canadian dollar gold over the past 3 months follows. Consider that while there have been no dramatic gains over this period, we also saw an early September jump in the Canadian dollar gold price, and Canadian dollar gold has been doing "just fine" ever since:

A close-up view of Canadian dollar gold over the past 3 months follows. Consider that while there have been no dramatic gains over this period, we also saw an early September jump in the Canadian dollar gold price, and Canadian dollar gold has been doing "just fine" ever since:

That is, we Canadians had our dramatic run-up in the November 2008 - February 2009 period, and have only been "marking time" since:

That is, we Canadians had our dramatic run-up in the November 2008 - February 2009 period, and have only been "marking time" since:

How has the SPTGD Toronto gold index responded to strength in the gold price in most world currencies?

How has the SPTGD Toronto gold index responded to strength in the gold price in most world currencies?

Ignoring gold's record February 2009 Canadian dollar high, this ornery bull followed suit, also moving to new highs (but not record highs) on about the same dates as did US dollar and Canadian dollar gold.

Ignoring gold's record February 2009 Canadian dollar high, this ornery bull followed suit, also moving to new highs (but not record highs) on about the same dates as did US dollar and Canadian dollar gold.

How has the SPTGD index fared since its September 2, 2009 ascension?

How has the SPTGD index fared since its September 2, 2009 ascension?

Aye, there's the rub....

Aye, there's the rub....

A close analysis shows that in the past 30 trading days, we have seen 5 good days and 25 "bad" days. By good days, I refer to the black-outlined bars filled with white, moving with two or more rising days in succession. These benign "white" bars show the SPTGD index starting out at a lower point, and rising to a significantly higher point for the day on more than one day.

A close analysis shows that in the past 30 trading days, we have seen 5 good days and 25 "bad" days. By good days, I refer to the black-outlined bars filled with white, moving with two or more rising days in succession. These benign "white" bars show the SPTGD index starting out at a lower point, and rising to a significantly higher point for the day on more than one day.

Though the SPTGD index moved higher on some of the other days, these were ambiguous days, for example, starting at new highs, but then falling for the day, or oscillating throughout the day with no appreciable change. Perhaps there was a single "good" day, but sandwiched between "bad" days.

Yes, with gold in US dollars at record highs, the SPTGD index of Canadian gold mining shares has so far managed a measly 5 unambiguously positive trading days since September 2!

This is what the old-timers call "rebalancing sentiment."

This is what the old-timers call "rebalancing sentiment."

In fact, the SPTGD index has climbed from below the 310 level on September 1 to the 337 level as I write. This is a respectable 9% gain over 30 trading days. Ask anyone, "If your portfolio gained 9% every 30 trading days, how would you feel?" Most of us would be pleased, as this would produce cumulative returns of about 60% per year (or roughly 90% per year if the returns were compounded)!

By the way, what appears to be going on in the gold market technically is an "ascending double bottom" in the gold stocks (2001, 2008), lagging gold's 1999-2001 double bottom by 7 years! Here is the long term gold chart, with the obvious double bottom in 1999-2001:

And here is the only long-term chart for gold stocks available on Stockcharts.com, the Philadelphia Gold and Silver Index (XAU):

And here is the only long-term chart for gold stocks available on Stockcharts.com, the Philadelphia Gold and Silver Index (XAU):

Note the contrasts: (1) gold's double bottom is "flat," (2) gold's bottom occurred two years earlier than the bottom in gold shares, (3) the second bottom in gold shares has lagged that in gold by 7 years, and (4) the second bottom in gold shares is a higher bottom (a bullish indicator).

Note the contrasts: (1) gold's double bottom is "flat," (2) gold's bottom occurred two years earlier than the bottom in gold shares, (3) the second bottom in gold shares has lagged that in gold by 7 years, and (4) the second bottom in gold shares is a higher bottom (a bullish indicator).

So where are we in gold shares? I think it is obvious to see that the pattern in gold shares is "very big," and that we are only just now getting started! This is particularly true in Canada, as our second bottom in gold stocks (see long-term SPTGD chart further above) was more severe, due to the ascending Canadian dollar.

The SPTGD index was priced at 151.52 in 2008 versus 83.97 in 2000, much weaker than the US-based HUI index of unhedged gold miners, which bottomed at 35.31 in 2000 versus a healthier low of 150.27 in 2008.

The SPTGD index was priced at 151.52 in 2008 versus 83.97 in 2000, much weaker than the US-based HUI index of unhedged gold miners, which bottomed at 35.31 in 2000 versus a healthier low of 150.27 in 2008.

I have long adhered to Jim Sinclair's prediction, that the Canadian dollar is headed for about US $1.25. But in the bigger scheme of things, we are now most of the way there....

I have long adhered to Jim Sinclair's prediction, that the Canadian dollar is headed for about US $1.25. But in the bigger scheme of things, we are now most of the way there....

I trust it is now obvious that the problem with bull market advances lies in how their gains occur. Long-term secular bull markets advance in such a way as to raise and then crush hope - repeatedly! This reliable bull market pattern discourages the uncommitted, and fails to attract the disinterested and the timid.

Emotionally, the bull market investing experience is briefly wildly euphoric, and then, more or less in succession: unsettling, discouraging, distasteful, deadening, sometimes boring, and at certain points sickening.... Until it... unexpectedly... happens all over again.

Emotionally, the bull market investing experience is briefly wildly euphoric, and then, more or less in succession: unsettling, discouraging, distasteful, deadening, sometimes boring, and at certain points sickening.... Until it... unexpectedly... happens all over again.

In short, it takes an iron stomach, and pretty decent abdominal strength, flexibility and coordination, to ride a bull.

My advice... ride it anyway. Don't be seduced by the broad bear market in general equities, which has nowhere in particular to go for probably another decade. Ride the bull market in gold (including precious metals and precious metal mining stocks) for ultimately satisfying returns. But... expect to be unsettled - perhaps most of the time - along the way.

My advice... ride it anyway. Don't be seduced by the broad bear market in general equities, which has nowhere in particular to go for probably another decade. Ride the bull market in gold (including precious metals and precious metal mining stocks) for ultimately satisfying returns. But... expect to be unsettled - perhaps most of the time - along the way.

As I'm sure they also say of bull riding at the rodeo grounds, bull market investing is an unusual kind of fun!

As I'm sure they also say of bull riding at the rodeo grounds, bull market investing is an unusual kind of fun!

(Special thanks to Bryan Eubanks in San Diego for this last image. I hope that readers will be reassured to know that he escaped serious injury!)

_Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2009/10/why-bull-markets-repel-most-investors.html

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

It's no secret that most investors - including "trained" professionals - miss most bull markets.

It's no secret that most investors - including "trained" professionals - miss most bull markets.If you've ever observed the bull riders at a rodeo, this will give you a pretty good idea of why we call them bull markets. They buck and kick to throw their riders off, and then they trample them underfoot.

I hear some readers asking, "Why are you saying this? Don't bull markets rise by definition?"

Yes, of course they do, but as has often been observed, bull markets inevitably "climb a wall of worry."

By way of contrast, bear markets - those in decline - drift down in a miasma of complacency. This dominant mood of bear market complacency, in turn, is punctuated by episodes of panic, which are then relieved by "dead cat bounces." These often lengthy "bounces" reassure present holders to stay the course, and lure holdouts to jump back in.

For our instruction, the "SPTGD" Toronto gold index is presently offering a textbook example of the kind of psychological angst that characterizes bull markets. Note the quick run-ups in the very first days of September and October 2009, followed by a relentless downward drift in each case. Note also the lower high in October, compared to the early September high. That is, if you had "known" what the market was going to do, you could have bought at the September 1, 2009 low, and sold at the September 4, 2009 intraday high - and you'd still be substantially better off than if you had held from September 1 through to the present.

For our instruction, the "SPTGD" Toronto gold index is presently offering a textbook example of the kind of psychological angst that characterizes bull markets. Note the quick run-ups in the very first days of September and October 2009, followed by a relentless downward drift in each case. Note also the lower high in October, compared to the early September high. That is, if you had "known" what the market was going to do, you could have bought at the September 1, 2009 low, and sold at the September 4, 2009 intraday high - and you'd still be substantially better off than if you had held from September 1 through to the present. Unlike bear market declines, where rare but rapid downward moves are "cascading" or "waterfall" like, bull market declines are lengthy, persistent, and at the end often harrowing, though usually in accord with a well-defined "declining wedge" pattern. The declining wedge may run sideways, as was recently seen in iShares Gold Trust (GLD), just prior to the September 2, 2009 upside breakout in the gold price:

Unlike bear market declines, where rare but rapid downward moves are "cascading" or "waterfall" like, bull market declines are lengthy, persistent, and at the end often harrowing, though usually in accord with a well-defined "declining wedge" pattern. The declining wedge may run sideways, as was recently seen in iShares Gold Trust (GLD), just prior to the September 2, 2009 upside breakout in the gold price: Or the wedge may run relentlessly downwards, as illustrated by this classic 1998-99 chart of Freeport-McMoran Copper and Gold (FCX), which occurred at the first "bottom" point of the 1999-2001 "double bottom," which in turn concluded the 21-year bear market in gold and commodities (including copper), which had persisted from 1980-2001:

Or the wedge may run relentlessly downwards, as illustrated by this classic 1998-99 chart of Freeport-McMoran Copper and Gold (FCX), which occurred at the first "bottom" point of the 1999-2001 "double bottom," which in turn concluded the 21-year bear market in gold and commodities (including copper), which had persisted from 1980-2001: As a point of interest, declining or "falling" wedges are paradoxically more bullish than ascending wedges, as can be seen in this illustration of Ann Taylor Stores' stock price in 1999. Note that today, 10 years later, this great company's stock is presently trading in a lower range than it did in 1999, though Ann Taylor Stores eventually recovered from its 1999-2000 decline to rise as high as $45.15 in 2006:

As a point of interest, declining or "falling" wedges are paradoxically more bullish than ascending wedges, as can be seen in this illustration of Ann Taylor Stores' stock price in 1999. Note that today, 10 years later, this great company's stock is presently trading in a lower range than it did in 1999, though Ann Taylor Stores eventually recovered from its 1999-2000 decline to rise as high as $45.15 in 2006: Let us direct further attention to the market's present behaviour. On Wednesday, September 2, 2009, gold broke out of its previous trading range, quickly ascending to new highs, and then moving on to its current record highs, as can be seen below:

Let us direct further attention to the market's present behaviour. On Wednesday, September 2, 2009, gold broke out of its previous trading range, quickly ascending to new highs, and then moving on to its current record highs, as can be seen below: Take into consideration that the record highs are so far only in US dollars, as Canadian dollar gold peaked at $1258 in February of this year (and I certainly expect Canadian dollar gold to leave the $1258 level behind before too many more months have gone by)....

Take into consideration that the record highs are so far only in US dollars, as Canadian dollar gold peaked at $1258 in February of this year (and I certainly expect Canadian dollar gold to leave the $1258 level behind before too many more months have gone by).... A close-up view of Canadian dollar gold over the past 3 months follows. Consider that while there have been no dramatic gains over this period, we also saw an early September jump in the Canadian dollar gold price, and Canadian dollar gold has been doing "just fine" ever since:

A close-up view of Canadian dollar gold over the past 3 months follows. Consider that while there have been no dramatic gains over this period, we also saw an early September jump in the Canadian dollar gold price, and Canadian dollar gold has been doing "just fine" ever since: That is, we Canadians had our dramatic run-up in the November 2008 - February 2009 period, and have only been "marking time" since:

That is, we Canadians had our dramatic run-up in the November 2008 - February 2009 period, and have only been "marking time" since: How has the SPTGD Toronto gold index responded to strength in the gold price in most world currencies?

How has the SPTGD Toronto gold index responded to strength in the gold price in most world currencies? Ignoring gold's record February 2009 Canadian dollar high, this ornery bull followed suit, also moving to new highs (but not record highs) on about the same dates as did US dollar and Canadian dollar gold.

Ignoring gold's record February 2009 Canadian dollar high, this ornery bull followed suit, also moving to new highs (but not record highs) on about the same dates as did US dollar and Canadian dollar gold. How has the SPTGD index fared since its September 2, 2009 ascension?

How has the SPTGD index fared since its September 2, 2009 ascension? Aye, there's the rub....

Aye, there's the rub.... A close analysis shows that in the past 30 trading days, we have seen 5 good days and 25 "bad" days. By good days, I refer to the black-outlined bars filled with white, moving with two or more rising days in succession. These benign "white" bars show the SPTGD index starting out at a lower point, and rising to a significantly higher point for the day on more than one day.

A close analysis shows that in the past 30 trading days, we have seen 5 good days and 25 "bad" days. By good days, I refer to the black-outlined bars filled with white, moving with two or more rising days in succession. These benign "white" bars show the SPTGD index starting out at a lower point, and rising to a significantly higher point for the day on more than one day.Though the SPTGD index moved higher on some of the other days, these were ambiguous days, for example, starting at new highs, but then falling for the day, or oscillating throughout the day with no appreciable change. Perhaps there was a single "good" day, but sandwiched between "bad" days.

Yes, with gold in US dollars at record highs, the SPTGD index of Canadian gold mining shares has so far managed a measly 5 unambiguously positive trading days since September 2!

This is what the old-timers call "rebalancing sentiment."

This is what the old-timers call "rebalancing sentiment."In fact, the SPTGD index has climbed from below the 310 level on September 1 to the 337 level as I write. This is a respectable 9% gain over 30 trading days. Ask anyone, "If your portfolio gained 9% every 30 trading days, how would you feel?" Most of us would be pleased, as this would produce cumulative returns of about 60% per year (or roughly 90% per year if the returns were compounded)!

By the way, what appears to be going on in the gold market technically is an "ascending double bottom" in the gold stocks (2001, 2008), lagging gold's 1999-2001 double bottom by 7 years! Here is the long term gold chart, with the obvious double bottom in 1999-2001:

And here is the only long-term chart for gold stocks available on Stockcharts.com, the Philadelphia Gold and Silver Index (XAU):

And here is the only long-term chart for gold stocks available on Stockcharts.com, the Philadelphia Gold and Silver Index (XAU): Note the contrasts: (1) gold's double bottom is "flat," (2) gold's bottom occurred two years earlier than the bottom in gold shares, (3) the second bottom in gold shares has lagged that in gold by 7 years, and (4) the second bottom in gold shares is a higher bottom (a bullish indicator).

Note the contrasts: (1) gold's double bottom is "flat," (2) gold's bottom occurred two years earlier than the bottom in gold shares, (3) the second bottom in gold shares has lagged that in gold by 7 years, and (4) the second bottom in gold shares is a higher bottom (a bullish indicator).So where are we in gold shares? I think it is obvious to see that the pattern in gold shares is "very big," and that we are only just now getting started! This is particularly true in Canada, as our second bottom in gold stocks (see long-term SPTGD chart further above) was more severe, due to the ascending Canadian dollar.

The SPTGD index was priced at 151.52 in 2008 versus 83.97 in 2000, much weaker than the US-based HUI index of unhedged gold miners, which bottomed at 35.31 in 2000 versus a healthier low of 150.27 in 2008.

The SPTGD index was priced at 151.52 in 2008 versus 83.97 in 2000, much weaker than the US-based HUI index of unhedged gold miners, which bottomed at 35.31 in 2000 versus a healthier low of 150.27 in 2008. I have long adhered to Jim Sinclair's prediction, that the Canadian dollar is headed for about US $1.25. But in the bigger scheme of things, we are now most of the way there....

I have long adhered to Jim Sinclair's prediction, that the Canadian dollar is headed for about US $1.25. But in the bigger scheme of things, we are now most of the way there....I trust it is now obvious that the problem with bull market advances lies in how their gains occur. Long-term secular bull markets advance in such a way as to raise and then crush hope - repeatedly! This reliable bull market pattern discourages the uncommitted, and fails to attract the disinterested and the timid.

Emotionally, the bull market investing experience is briefly wildly euphoric, and then, more or less in succession: unsettling, discouraging, distasteful, deadening, sometimes boring, and at certain points sickening.... Until it... unexpectedly... happens all over again.

Emotionally, the bull market investing experience is briefly wildly euphoric, and then, more or less in succession: unsettling, discouraging, distasteful, deadening, sometimes boring, and at certain points sickening.... Until it... unexpectedly... happens all over again.In short, it takes an iron stomach, and pretty decent abdominal strength, flexibility and coordination, to ride a bull.

My advice... ride it anyway. Don't be seduced by the broad bear market in general equities, which has nowhere in particular to go for probably another decade. Ride the bull market in gold (including precious metals and precious metal mining stocks) for ultimately satisfying returns. But... expect to be unsettled - perhaps most of the time - along the way.

My advice... ride it anyway. Don't be seduced by the broad bear market in general equities, which has nowhere in particular to go for probably another decade. Ride the bull market in gold (including precious metals and precious metal mining stocks) for ultimately satisfying returns. But... expect to be unsettled - perhaps most of the time - along the way. As I'm sure they also say of bull riding at the rodeo grounds, bull market investing is an unusual kind of fun!

As I'm sure they also say of bull riding at the rodeo grounds, bull market investing is an unusual kind of fun!(Special thanks to Bryan Eubanks in San Diego for this last image. I hope that readers will be reassured to know that he escaped serious injury!)

_Source URL: http://idontwanttobeanythingotherthanme.blogspot.com/2009/10/why-bull-markets-repel-most-investors.html

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

No comments:

Post a Comment