This is a legacy article from 2005 which I though might be interesting to update and republish. Here, for your interest, is the original text, followed by today's update at the end:

I was reading the most recent issue of Fortune Magazine last night, and what should be on the cover but bars of gold bullion? As you might imagine, Gold is now on Fortune’s top 25 list of recommended investments for 2006.

There is presently much discussion among precious metals analysts as to whether we have entered “stage two” of gold’s bull market, which is expected to be marked by increased mainstream interest in gold investment. I will attempt to show here, in accord with one of my mentors, Ed Bugos (http://www.goldenbar.com/), that despite increasing public interest, we remain in “stage one” of the gold bull market, though I believe stage two is fast approaching.

There is presently much discussion among precious metals analysts as to whether we have entered “stage two” of gold’s bull market, which is expected to be marked by increased mainstream interest in gold investment. I will attempt to show here, in accord with one of my mentors, Ed Bugos (http://www.goldenbar.com/), that despite increasing public interest, we remain in “stage one” of the gold bull market, though I believe stage two is fast approaching.Bull markets are generally presumed to evolve through three stages. In the first stage, astute individuals who are alert to emerging trends often experience considerable gains while their area of investment interest remains "under the radar."

In stage two, the general public and the professional investment community develop increasing interest in the emerging opportunities in a particular field of investment. In my understanding, stage two is typically characterized by increased risk, as a later stage pullback can erase the gains of new investors, and restore investment values to levels somewhere between the peak and the (typically lower) close of stage one. This is significant, as some early investors may sell out to new investors at or near the stage two peak, and new investors tend to become discouraged with the new bull market after a dramatic pullback has erased their gains.

Strikingly, just at the point where the general public and the broader investment community (including the majority of professional advisors) become most disillusioned with the now maturing bull market, stage three typically begins. Once again, the early investors, who have a clearly thought-through rationale for their investment preferences, are those most likely to benefit by the third, and most dramatic bull market stage, which is one of parabolic growth over a relatively short period of time.

I can think of two excellent illustrations of these three bull market stages. The first is the gold bull market of the 1970’s, which ended in a dramatic 1980 peak with gold values over $800 per ounce.

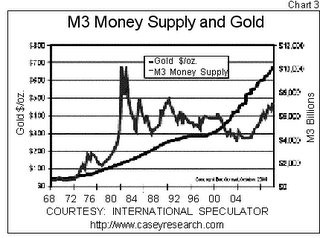

NOTE: All three charts originated by Mary Ann and Pamela Aden (http://www.adenforecast.com/). Readers are advised to visit their excellent website for fuller understanding.

In stage one, gold values began drifting up from $35 per ounce, where they had been fixed by international accord through 1968. In 1971, President Nixon removed the US dollar from the gold standard, thereby fully opening up the value of gold to market pricing, which saw gold’s advance to about $120 per ounce in 1973. Stage one closed when gold pulled back modestly to about $100 later that year.

Stage two of the gold bull market was associated with the return of private ownership of gold to US citizens in 1974. The gold price moved up rapidly, almost to $200 by 1975, drawing in increasing public interest. But, as is characteristic of bull markets in their second stage, gold’s price then pulled back to the $100 per ounce range, thereby erasing the gains of new investors, but preserving the gains of the early investors.

As is typically the case in bull markets, this second stage collapse actually set the stage for the stage three parabolic move upwards in gold’s value to over $800 per ounce.

By 1980, with gold nearing its peak values, market fundamentals changed, and the wisest of investors sold their holdings of gold in recognition of the changed fundamental situation. (The best known of these is Jim Sinclair: http://www.jsmineset.com/).

My second example of a three stage bull market is the recently concluded “technology bubble.” The three stages are well-illustrated in a study of the shares of Dell Computer. Dell’s stage one accumulative phase continued through the end of 1992, at which point the price (in contemporary post-split terms) had risen from mere pennies to 78 cents a share, creating dramatic gains for early holders. However, stage one concluded with a pullback to 22 cents per share in 1993.

This laid the foundation for the stage two rise to $1.54 per share in late 1995, essentially doubling the gains of early stage one investors, and increasing the holdings of early stage two investors sixfold.

However, Dell’s share value then collapsed dramatically by over 50% to 72 cents per share that same year, essentially erasing all of the share value gains from the 1992 peak through to 1995 – a discouraging three-year period of non-performance.

This wrenching late stage two pullback, once again, set the stage for a dramatic stage three bull market move for Dell. From its 1995 low of 72 cents, Dell never looked back until 2000, at which point it had attained a value of $59.69 per share, confirming the wisdom of the longer term investors who had correctly perceived (or luckily discovered) that Dell had entered its stage three bull market phase.

Note that the shares of Dell are now unwinding, as did the value of gold after 1980, and that, in my opinion, Dell’s shares have much more to lose before its “secular” bear market is done. Dell had collapsed to the $16 range shortly after its 2000 bull market peak. It since recovered to a $42.57 high in late 2004, but in my view will be facing a long downward slope for many years to come as the investment community gradually recognizes that computer hardware has become a “commodity” in an emerging globalized economy (that is, fundamental factors have again brought an end to a dramatic and exciting bull market).

Looking back to the 1970’s gold bull market, and its subsequent 1980-2001 bear market decline, it strikes me that bear markets may be characterized by three stages as well. The bear market pullback may appear less dramatic in terms of the currency value of shares, due to the persistent eroding background interference of monetary inflation, which, by matter of government policy, steadily undermines the purchasing power of all money.

In my view, the 1980-82 gold market decline would constitute stage one of the bear market, pulling the price back inside the long-term channel of gold’s appreciating value in terms of a steadily inflating currency; then 1982-93 constituted stage two, returning the price to the middle of the channel defining gold’s value in terms of an inflating currency; and 1993-2001 constitutes stage three of the bear market, bringing the price of gold to a 21 year channel bottom, and preparing the stage for the present gold bull market.

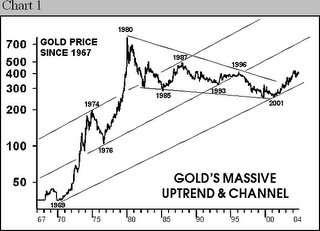

Given that the length of gold’s recent (1980-2001) bear market was almost twice as long as its 12-year 1968-1980 bull market, I now suspect that we may be seeing a much longer and more gradual, but ultimately more powerful gold bull market than in the 1970’s.

Chart analysis shows that we have not yet attained even gold’s long-term mid-channel values (presently in the $600 per ounce range), and there is still the move to the top of the channel to anticipate (stage two), as well as a possible parabolic move above the channel to culminate stage three of the present gold bull market.

The background to my speculation that the present gold bull market will be lengthier and more powerful than the 1970’s bull market is due in large part to the fact that the value of gold mining company shares steadily weakened against the value of gold from the date of the initial free market trading of gold (1968) through 1980.

In the present gold bull market, gold mining company shares have appreciated strongly relative to the value of gold, obviously due to the fact that their relative value remains, even now, in a 36-year downtrend.

I find it difficult to countenance that the value of gold shares relative to gold will not break out of their present 36-year downtrend channel during the present gold bull market

I find it difficult to countenance that the value of gold shares relative to gold will not break out of their present 36-year downtrend channel during the present gold bull market

Any breakout in share values above this channel top (we are now very near this point) will almost certainly see an end-of-stage-one pullback to the upper line of the (gold share relative value) downtrend channel, possibly on a strong move in gold, though possibly also due to short-term renewed weakness in the gold mining shares due to a range of very real fundamental issues, including inflating production costs, political risk, and questions about demand for gold at higher prices (by the way, don't worry about this latter issue – if any currency were climbing in value, would people wish to own more or less of it?).  On the upside, resistance to gold shares’ continued upward movement will be set by their 1993, 1973 and 1969 highs, respectively.) The time to sell gold shares and diversify into other investments would be at the time that the 1969 ratio high is reattained, very likely a decade or two in the future, if not longer. By then, equities, bonds or some other class of investment (perhaps real estate) would likely have returned to attractive values.

On the upside, resistance to gold shares’ continued upward movement will be set by their 1993, 1973 and 1969 highs, respectively.) The time to sell gold shares and diversify into other investments would be at the time that the 1969 ratio high is reattained, very likely a decade or two in the future, if not longer. By then, equities, bonds or some other class of investment (perhaps real estate) would likely have returned to attractive values.

As I am working with a conceptual model which indicates that the present bull market in gold and gold shares could last much longer than the 1970’s “flash in the pan” gold bull market, I suggest that we could anticipate 20 or even 30 more years of strength in gold mining shares relative to gold. Bear in mind that only 4 years have been logged so far. Of course, there will be many surges up and down along the way. But a 20 to 30-year buy and hold strategy in gold mining shares would seem to be a workable choice in this market, even allowing for the likelihood that there will be a substantial correction at the end of stage one (if it has not already concluded), and an even greater, perhaps 50% correction, at the close of stage two.

So if we are not yet in stage two in this bull market, where are we? I suggest that we probably are moving quite near to the end of stage one, which I expect to conclude with gold values in the $600 per ounce range.

However, stage one is also likely to conclude with a greater correction in the price of gold than we have seen so far (that is, closer to a 20% - or greater - correction than to a 10% correction). The associated correction in gold shares may be more modest, and is more likely to follow the gold shares’ breakout from their 36-year downtrend than to precede that breakout move.

Psychologically, while Fortune Magazine’s cover certainly signals awakening public interest in the gold market, there remain several missing pieces to that puzzle as well. To begin, while gold itself has qualified as a recommended investment for 2006, no gold or precious metal mining companies have yet been named. Secondly, the analysis offered by Andy Serwer really neglects the primary driver of gold’s appreciation, which is ongoing inflation in the quantity of money in all of the world’s major currencies. I believe that a fundamental grasp of gold’s role as a hedge against deterioration in the value of money will need to be more clearly understood during stage two of the gold bull market.

I invite readers to share their thoughts and comments about gold’s three-stage bull market with me.

10 August 2008: Also - be sure to read my more recent posts on the topics of precious metals and secular trends, starting here: "Gold's 1980 High – Think $5000 - No $6000 - per Ounce."

16 April 2010: I thought this topic was important enough to revisit 5 years later. Though some details may be off to some degree (particularly my prediction that stage one would run no higher than $600 or so), the scenario I painted in 2005 has more or less come to pass. In my view, the 34% pullback in the gold price in October 2008 (from $1033.90 to $681.00) constituted the end of stage one in the present 3-stage gold bull market. The recovery in the gold price from this level since that time appears to constitute the early era of stage two, and that is where we are now.

Where then will stage two end? Pamela and Mary Anne Aden have recently proposed that the gold price is likely to see a level over $2000, perhaps as high as $3000, by February 2012 or so.

Where then will stage two end? Pamela and Mary Anne Aden have recently proposed that the gold price is likely to see a level over $2000, perhaps as high as $3000, by February 2012 or so.

This prediction is based on a pattern of gold prices reaching peaks 11 years following major lows. The assumption is that a large pullback would follow that interim high - and then the fabled stage three would launch from the second primary pullback low.

Gold analysts generally expect stage three to be a "bubble" stage, during which the gold price will rise to unprecedented levels in an atmosphere of general panic. I have blogged earlier that the gold price can easily run to a level of $6000 or higher, depending on what happens with inflation, which of course now appears to be picking up steam.

Gold analysts generally expect stage three to be a "bubble" stage, during which the gold price will rise to unprecedented levels in an atmosphere of general panic. I have blogged earlier that the gold price can easily run to a level of $6000 or higher, depending on what happens with inflation, which of course now appears to be picking up steam.

As the chart above shows (comparing gold to previous well-established investment bubbles), there is no detectable "bubble" action in the price of gold at all so far, so it is not difficult to envision how the gold bull market could easily extend for an additional decade or so from here.

As the chart above shows (comparing gold to previous well-established investment bubbles), there is no detectable "bubble" action in the price of gold at all so far, so it is not difficult to envision how the gold bull market could easily extend for an additional decade or so from here.

Speaking in broad brush terms, if stage two wraps up with a primary correction (that is, a major pullback) in say 2012 or 2013, then the stage three bubble high will occur some years after that. We are now of course speaking very speculatively. But if the Adens are correct in describing an 11-year pattern in gold price highs, then the bubble peak might possibly occur 11 years following the October 2008 low, that is, somewhere near the year 2019. This speculation thus projects that the present gold bull market will run approximately 18 years from 2001 through 2019 or so.

Interestingly, drawing on a separate source, Jim Rogers has recently reminded his followers that "previous commodity bull markets averaged about 17 to 18 years in length and experienced very large percentage increases." That is, the speculation that stage three of the present gold bull market might run approximately to the year 2019 is well-grounded in history.

Interestingly, drawing on a separate source, Jim Rogers has recently reminded his followers that "previous commodity bull markets averaged about 17 to 18 years in length and experienced very large percentage increases." That is, the speculation that stage three of the present gold bull market might run approximately to the year 2019 is well-grounded in history.

If I have been wrong anywhere so far in my original 2005 speculations about the 3-stage gold bull market, it has been in my original assumption that gold stocks would begin to leverage the gold price early in the process.

In fact, gold stocks well outperformed gold from 2001-2003, and since that time (now almost 7 years), have dramatically underperformed gold itself, as can be seen in the chart above (and the HUI index is the best-performing of the alternative gold stock indices!).

In fact, gold stocks well outperformed gold from 2001-2003, and since that time (now almost 7 years), have dramatically underperformed gold itself, as can be seen in the chart above (and the HUI index is the best-performing of the alternative gold stock indices!).

If gold stock investors (I am one) can take any solace, then it is in the current positive trend in the price of gold stocks relative to gold since October 2008, as can be seen in the same chart. Should gold stocks continue their more recent pattern, then it is possible that we could see a new high in the HUI:Gold ratio by February 2012 or so. Given that gold exploration and mining companies (1) own gold in the ground at a substantial discount to the market price of gold itself, and (2) have established their ability to get it out of the ground efficiently, that would in fact be a rational outcome, though as all investors know, markets are under no requirement whatsoever to perform in a rational manner at any time!

If gold stock investors (I am one) can take any solace, then it is in the current positive trend in the price of gold stocks relative to gold since October 2008, as can be seen in the same chart. Should gold stocks continue their more recent pattern, then it is possible that we could see a new high in the HUI:Gold ratio by February 2012 or so. Given that gold exploration and mining companies (1) own gold in the ground at a substantial discount to the market price of gold itself, and (2) have established their ability to get it out of the ground efficiently, that would in fact be a rational outcome, though as all investors know, markets are under no requirement whatsoever to perform in a rational manner at any time!

(The photo above is of the new headframe at the Goldcorp Red Lake Gold Mine, in which my wife and I are investors.)

_

Visit i dont want tobe anything other than me for Daily Updated Hairstyles Collection

No comments:

Post a Comment